Asia Stocks Edge Higher as Traders Await Fed Clues: Markets Wrap

NeutralFinancial Markets

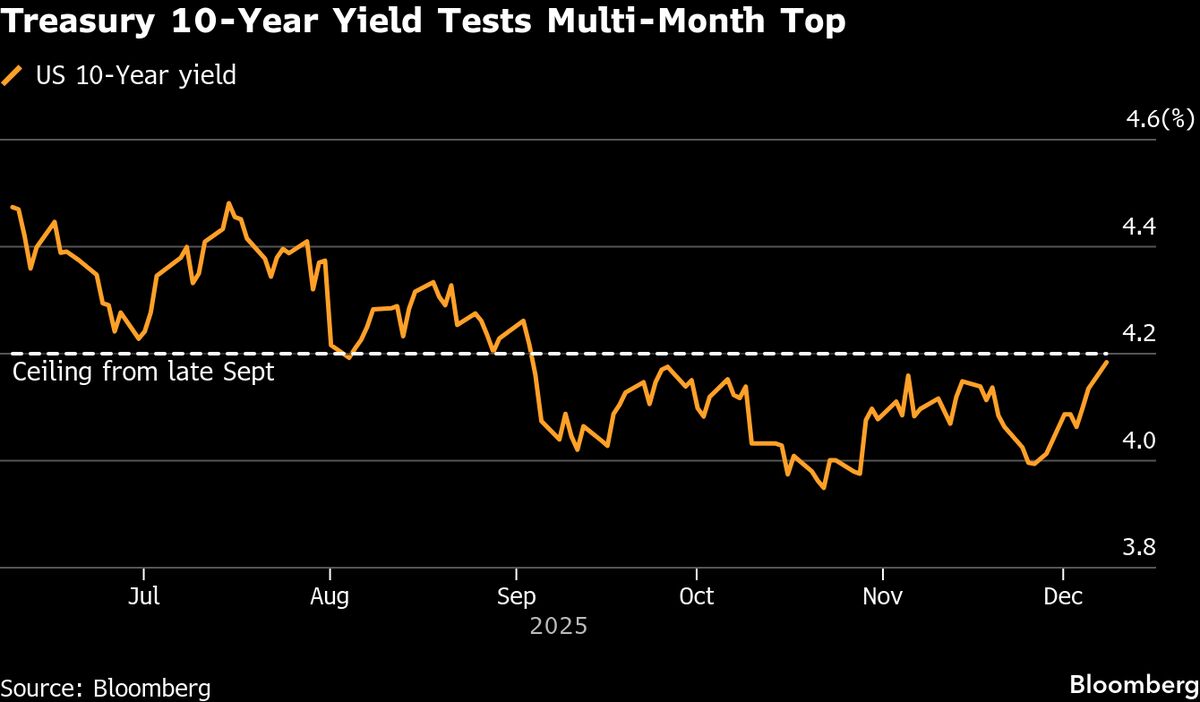

- Asian stocks saw a modest increase in early trading, following a lackluster session on Wall Street, as investors remain on edge awaiting insights into the Federal Reserve's interest rate decisions for the year. This cautious optimism reflects a broader sentiment in the markets as traders prepare for potential shifts in monetary policy.

- The anticipation surrounding the Federal Reserve's upcoming policy meeting is significant, as it could influence interest rates and overall market dynamics. Investors are particularly focused on how these decisions may affect economic growth and stock performance in the coming months.

- The current fluctuations in Asian markets are part of a larger trend of mixed global market performance, with concerns about a potential tech bubble and varying investor sentiment. As traders navigate these uncertainties, the interplay between U.S. and Asian markets highlights the interconnected nature of global finance, especially in light of recent discussions regarding interest rate cuts and their implications.

— via World Pulse Now AI Editorial System