‘Hawkish’ Fed cut likely as inflation risks limit future easing

PositiveFinancial Markets

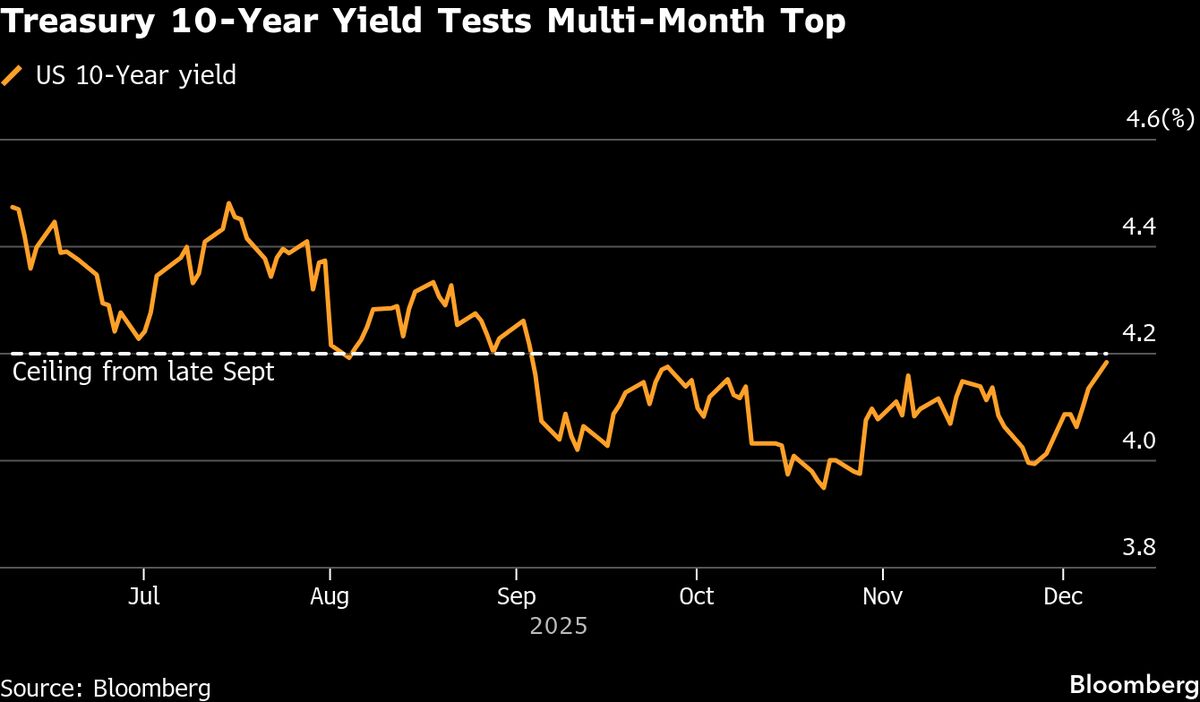

- The Federal Reserve is expected to announce a cut in interest rates this week, a move that has been anticipated by investors, businesses, and consumers as a response to ongoing inflation risks. This potential cut follows a period of rising stock and bond prices, reflecting market optimism about easing monetary policy.

- This development is significant as it may provide short-term relief to borrowers and stimulate economic activity, but it also raises concerns about the Fed's future policy direction amid persistent inflationary pressures.

- The broader context reveals a divided sentiment among market participants, with some bond traders expressing skepticism about the sustainability of rate cuts beyond December, highlighting the complexities of the current economic landscape and the Fed's balancing act between stimulating growth and controlling inflation.

— via World Pulse Now AI Editorial System