Bond Traders Cast Doubt on Extended Fed Rate Cuts Past December

NegativeFinancial Markets

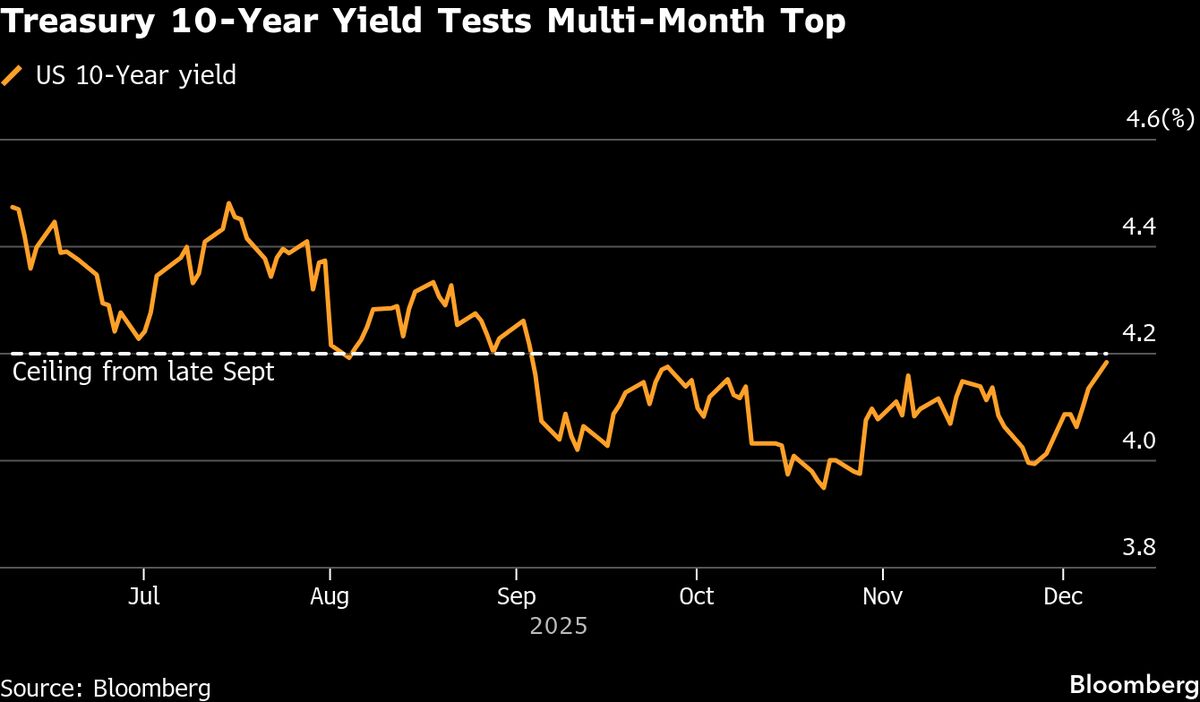

- Bond traders are expressing skepticism regarding the likelihood of extended interest rate cuts by the Federal Reserve beyond December, indicating a shift in market sentiment towards a shallower path of monetary easing. This comes amid ongoing discussions about the balance between a weakening labor market and rising inflation, which have created uncertainty in economic forecasts.

- The implications of this skepticism are significant for the Federal Reserve, as it suggests that traders are less confident in the central bank's ability to continue aggressive rate cuts. This could affect the Fed's monetary policy decisions and influence market dynamics as investors adjust their strategies in response to perceived risks.

- This development reflects broader trends in financial markets, where expectations for future rate cuts are being tempered by mixed economic signals. While some investors are betting on a December cut, others are cautious, highlighting a divergence in market reactions and the complexities of navigating monetary policy in an uncertain economic environment.

— via World Pulse Now AI Editorial System