Asian Stocks Set to Advance, Oil Drops on OPEC+: Markets Wrap

PositiveFinancial Markets

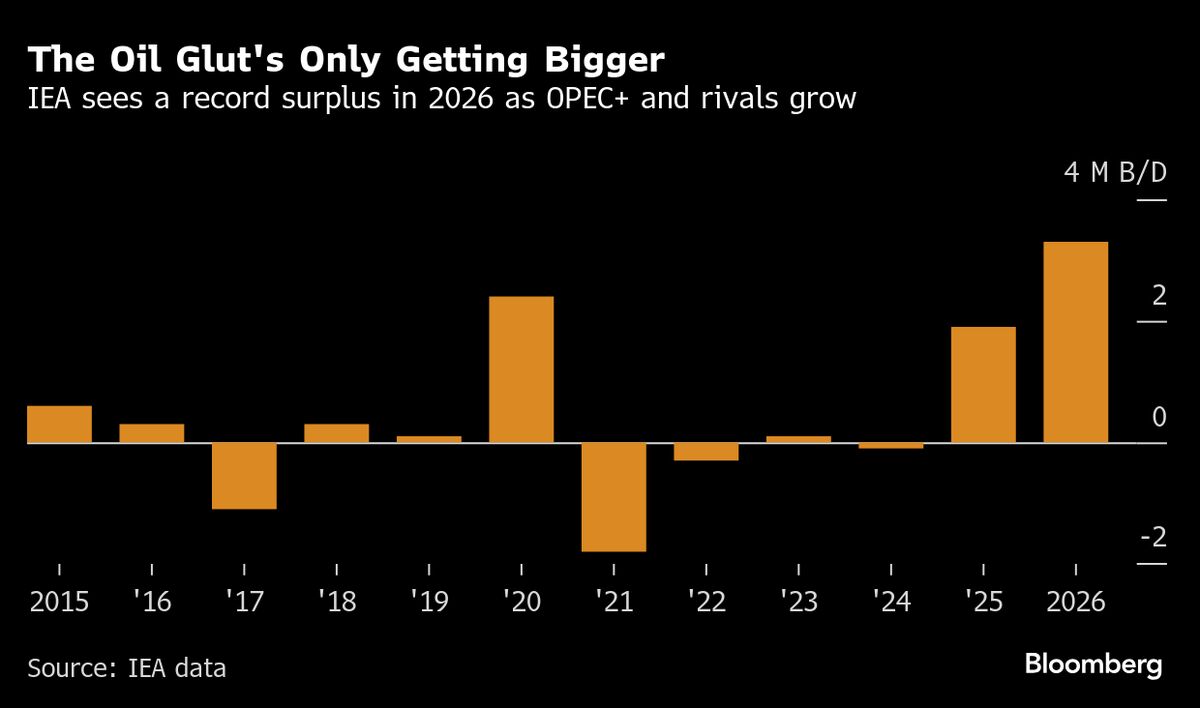

Asian stocks are expected to rise at the market open, buoyed by a recent inflation report from the US that met expectations. This positive economic indicator has helped lift shares in the last trading session, suggesting a favorable outlook for investors. The drop in oil prices, influenced by OPEC+ decisions, adds another layer of interest for market watchers, making this a significant moment for both regional and global markets.

— Curated by the World Pulse Now AI Editorial System