Oil slips as Kurdistan crude exports resume, OPEC+ plans output hike

NeutralFinancial Markets

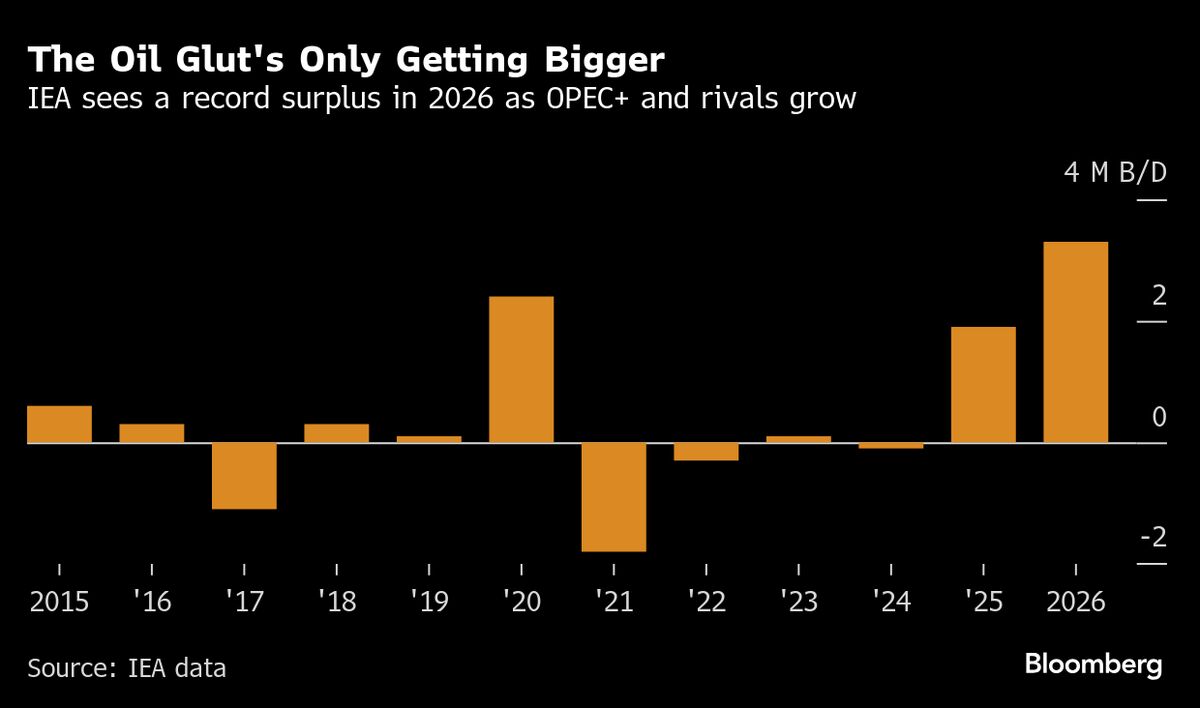

Oil prices have dipped as Kurdistan resumes its crude exports, while OPEC+ is planning an output increase. This development is significant as it reflects the ongoing dynamics in the global oil market, where supply adjustments can impact prices and economic stability. The resumption of exports from Kurdistan could lead to increased competition in the market, affecting both producers and consumers.

— Curated by the World Pulse Now AI Editorial System