Oil prices slip as OPEC+ reportedly plans another output hike

NeutralFinancial Markets

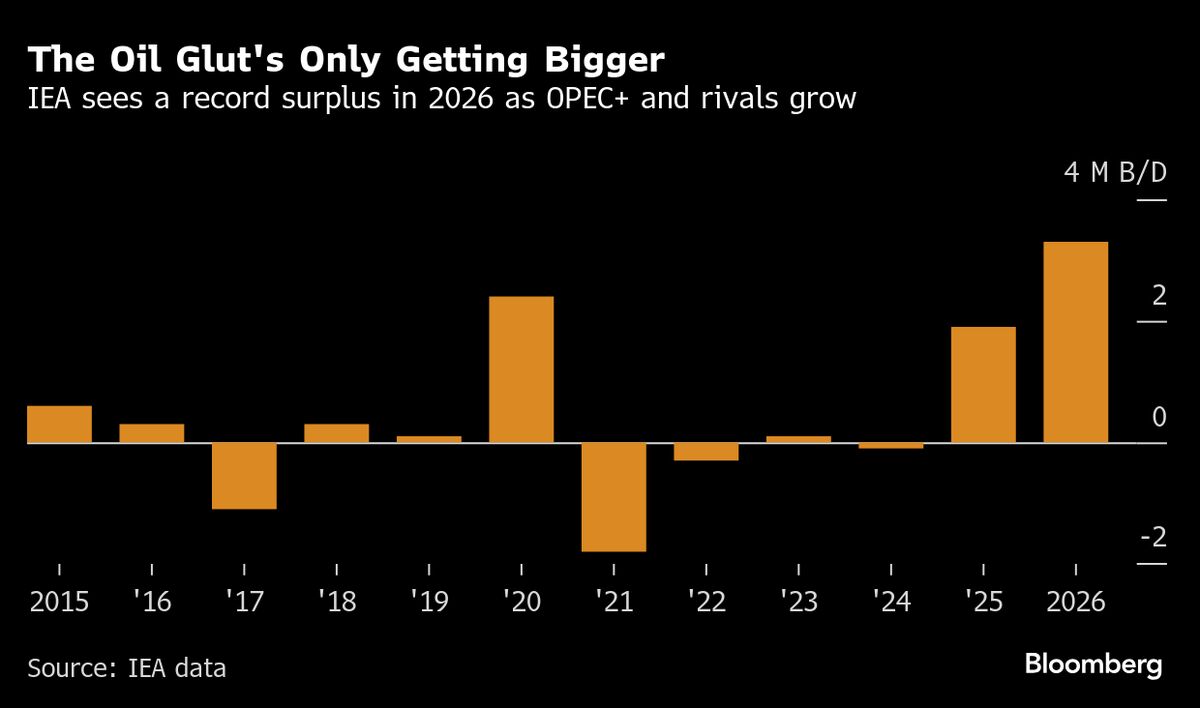

Oil prices have seen a slight decline as reports emerge that OPEC+ is considering another output hike. This development is significant as it could impact global oil supply and prices, influencing economies worldwide. Investors and analysts are closely monitoring these changes, as they may affect everything from fuel costs to inflation rates.

— Curated by the World Pulse Now AI Editorial System