Micron just sent a signal Wall Street hasn’t seen in years

PositiveFinancial Markets

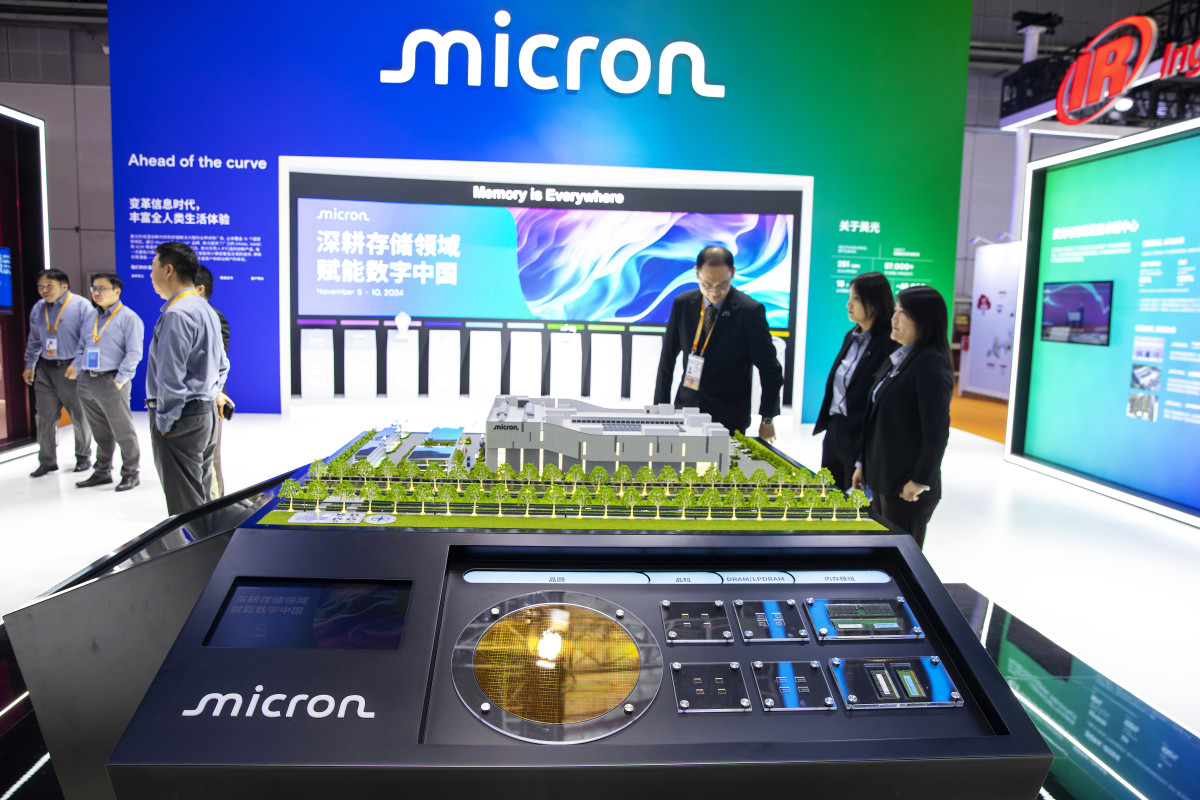

- Micron Technology has indicated a significant shift in memory demand, reflecting broader changes in the semiconductor industry as it adapts to evolving market needs. This development highlights Micron's strategic pivot towards AI-driven enterprise solutions, moving away from traditional consumer memory products.

- This transition is crucial for Micron as it positions the company to capitalize on the growing demand for artificial intelligence technologies, which are increasingly becoming integral to various sectors. The ability to align its offerings with market trends may enhance Micron's competitive edge and financial performance.

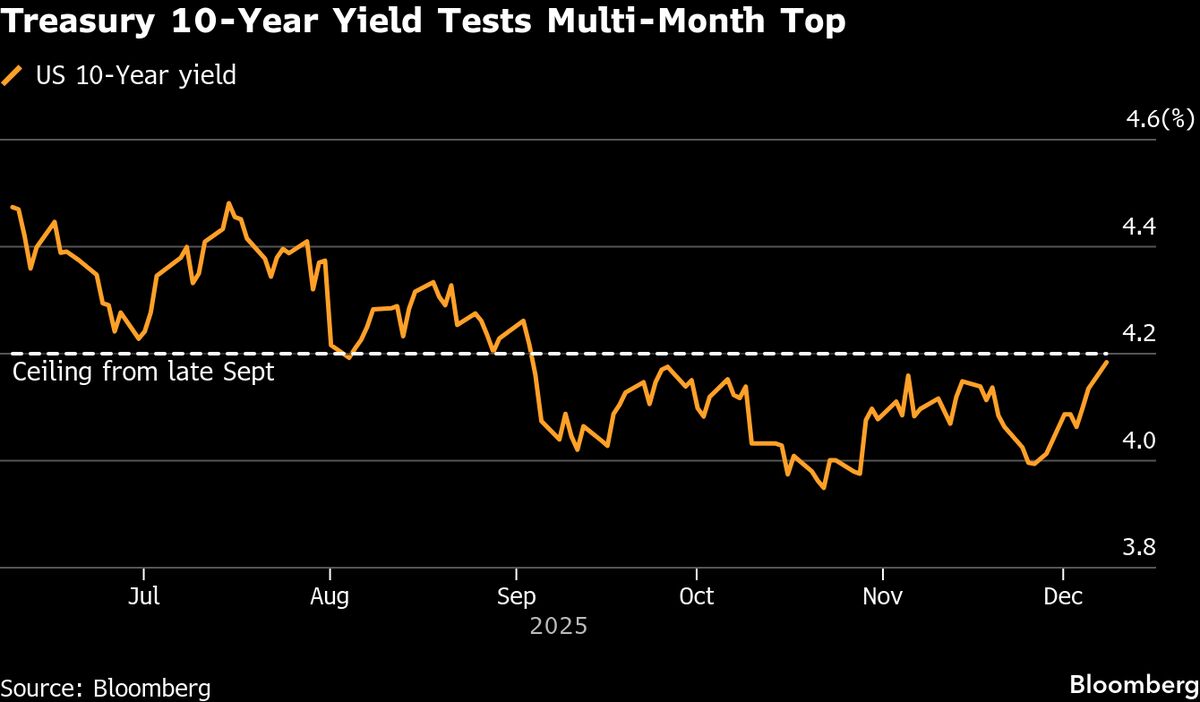

- The broader market context reveals a mixed sentiment on Wall Street, with recent fluctuations driven by concerns over tech stock volatility and potential AI bubble fears. Despite these challenges, Micron's proactive approach and the positive earnings reports from companies like Dell suggest a resilient demand for AI-related products, indicating a potential recovery in the tech sector.

— via World Pulse Now AI Editorial System