Wall Street Holds Off on Big Bets Ahead of Fed Day: Markets Wrap

NeutralFinancial Markets

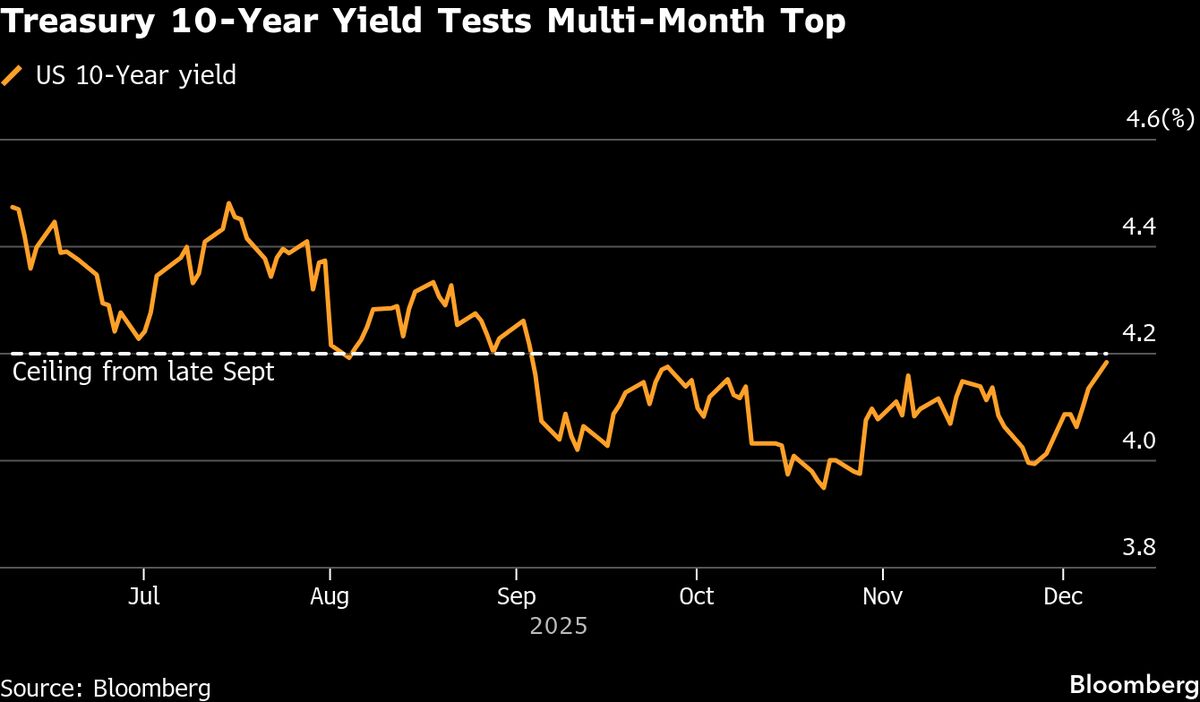

- Wall Street traders are refraining from making significant investments as they await the Federal Reserve's final interest-rate decision of 2025, scheduled for tomorrow. This cautious approach reflects uncertainty regarding the central bank's monetary policy direction for the upcoming year.

- The Federal Reserve's decision is critical as it will influence interest rates, impacting borrowing costs and economic growth. Traders are particularly attentive to any signals that may indicate a shift in the Fed's stance, which could affect market dynamics significantly.

- This situation unfolds against a backdrop of fluctuating global markets, with concerns about a potential tech bubble and mixed signals from economic indicators. Investor sentiment remains cautious, as recent data has raised questions about the labor market, further complicating expectations for the Fed's monetary policy.

— via World Pulse Now AI Editorial System