Wall Street Is Shaking Off Fears of an A.I. Bubble. For Now.

NeutralFinancial Markets

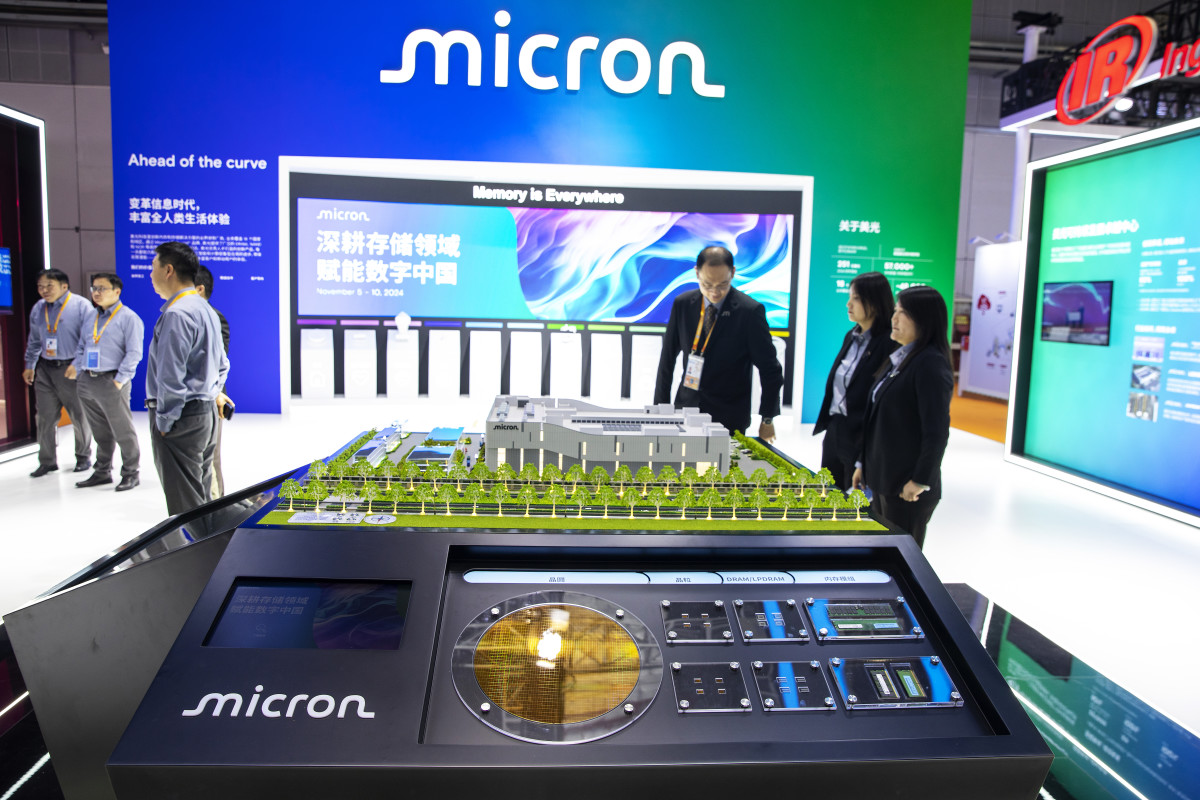

- Wall Street is currently experiencing a complex dynamic as fears of an artificial intelligence (A.I.) bubble resurface, reminiscent of the dot

- This situation is critical for investors and companies involved in A.I., as the market's confidence is fragile. The recent performance of companies like Nvidia has not fully alleviated concerns, indicating a cautious approach among stakeholders.

- The broader context reveals a mixed sentiment in the markets, with some sectors benefiting from the A.I. boom while others face declines. The ongoing debate about the sustainability of A.I. investments highlights the tension between optimism for technological advancements and the risk of overvaluation, reflecting a complex landscape for future economic stability.

— via World Pulse Now AI Editorial System