Popular analyst says you're ignoring 6 reasons behind stock market's next move

NeutralFinancial Markets

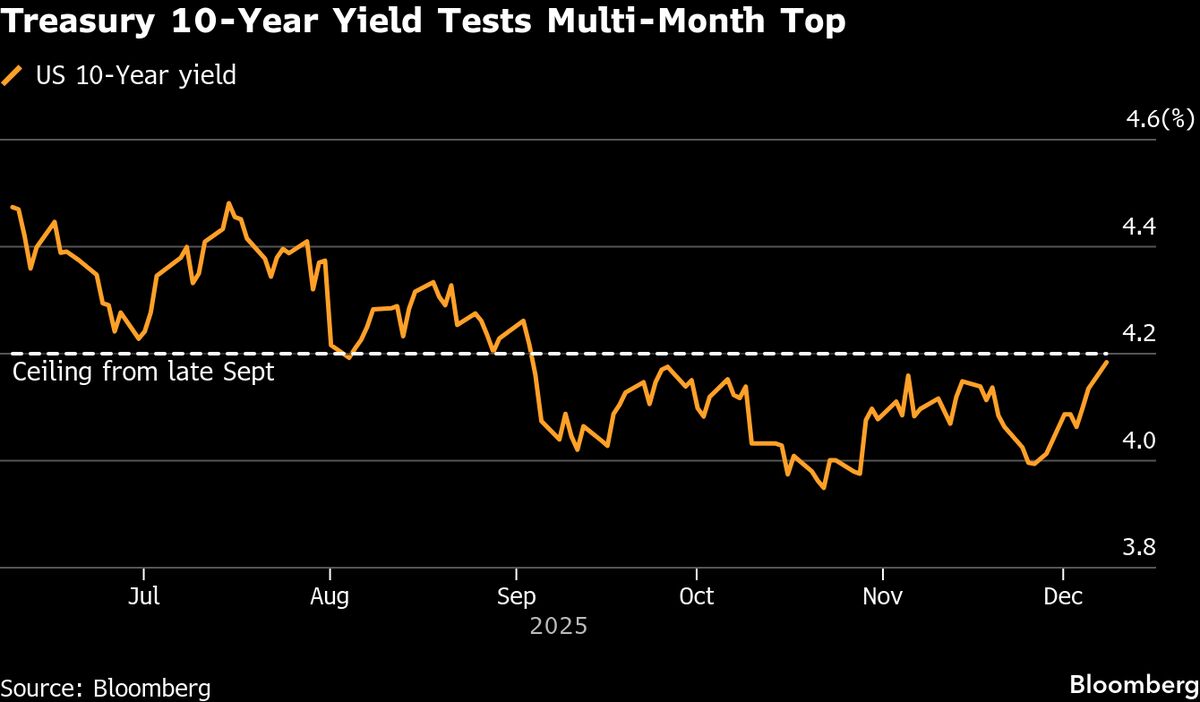

- Tom Lee, a veteran Wall Street analyst and founder of Fundstrat, has identified six key reasons that could influence the next movements in the stock market, emphasizing the importance of understanding these factors for investors.

- Lee's insights are particularly significant as they come from his extensive experience tracking market trends since the 1990s, positioning him as a credible voice for money managers and high

- The discussion around market dynamics is further complicated by concerns from other financial leaders, such as MFS CEO Ted Maloney, who warns of risks associated with market concentration and technology sector valuations, highlighting the need for disciplined investment strategies in an evolving financial landscape.

— via World Pulse Now AI Editorial System