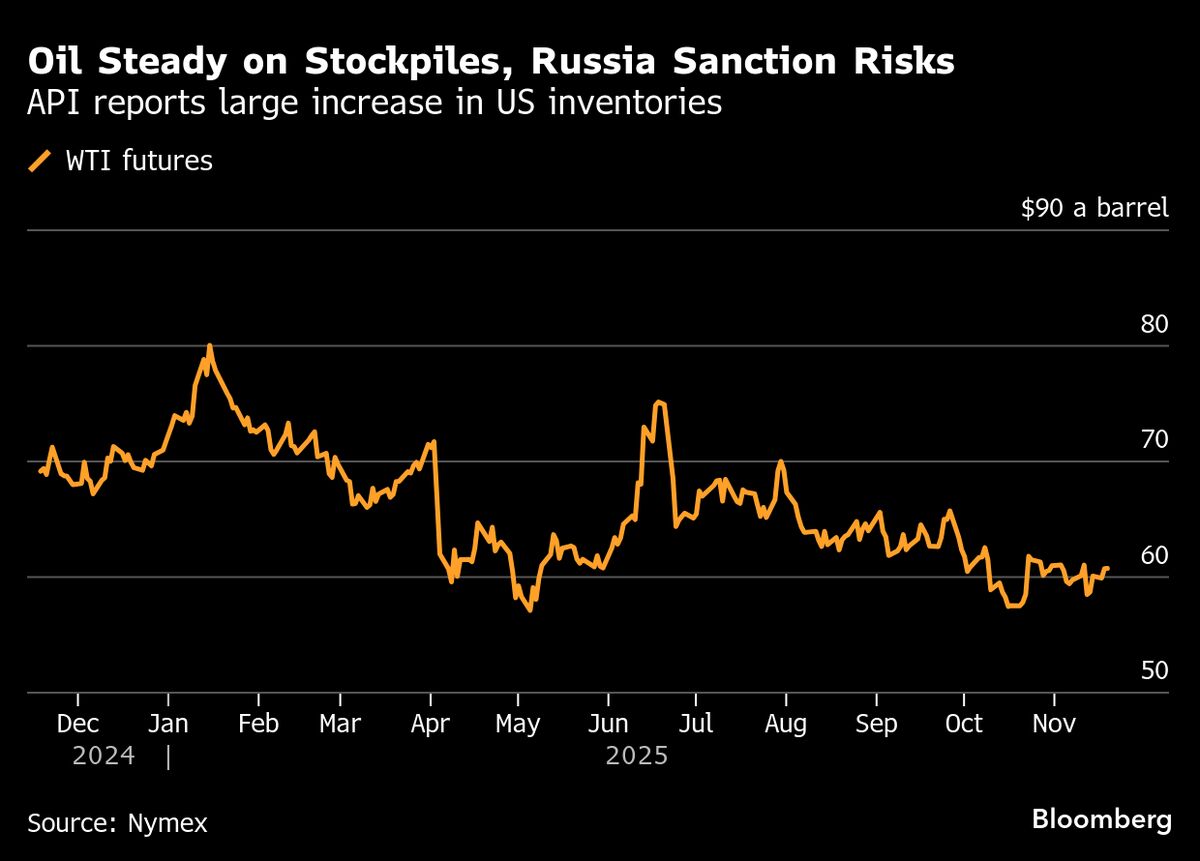

On the front line of Europe's standoff with Russia's sanction-busting shadow fleet

NegativeFinancial Markets

- Europe has enacted sanctions against Moscow, resulting in a rise of vessels sailing under no flag through its waters, indicating a growing shadow fleet that undermines these sanctions.

- This development raises concerns about the effectiveness of European sanctions and highlights the challenges in enforcing maritime regulations against Russia's attempts to bypass international restrictions.

— via World Pulse Now AI Editorial System