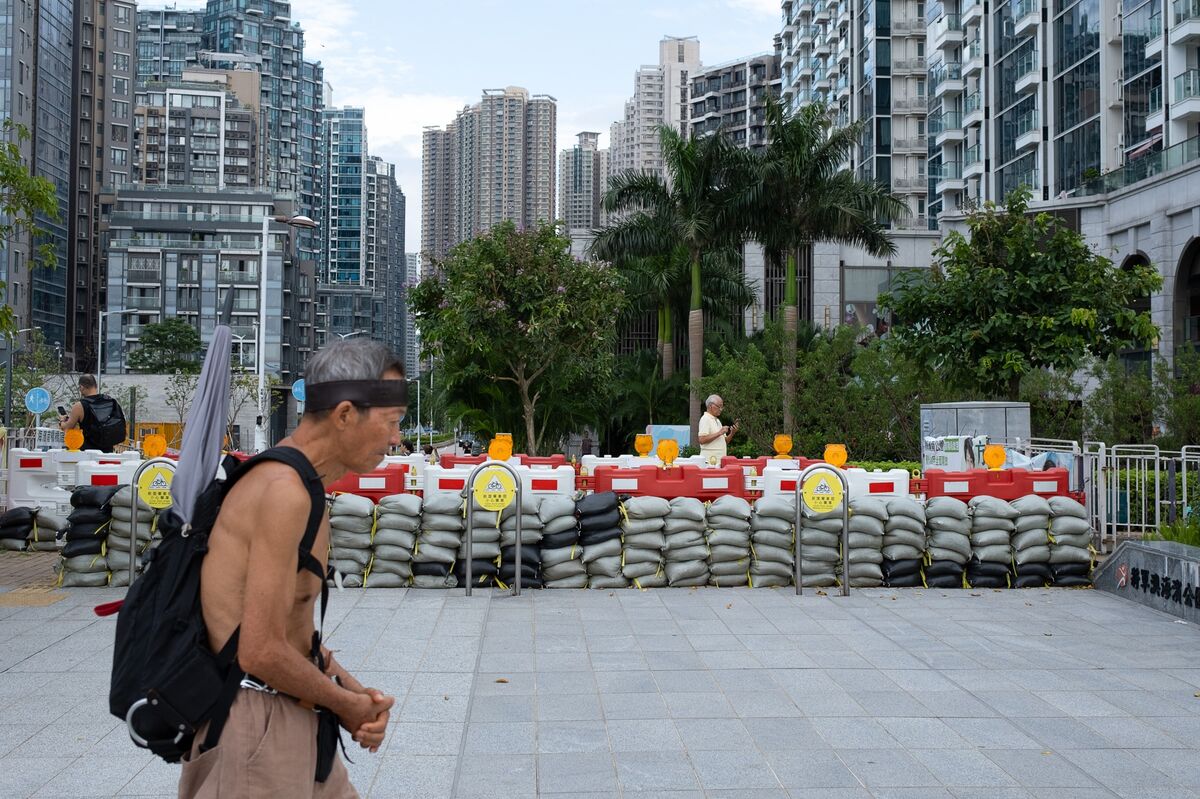

How Typhoons Can Delay Big IPOs Like Zijin Gold’s $3.2 Billion Deal in Hong Kong

NeutralFinancial Markets

Typhoons can significantly impact major financial transactions, as seen with Zijin Gold's $3.2 billion IPO in Hong Kong. This situation highlights the vulnerability of even the most sophisticated financial centers to natural disasters, raising questions about contingency planning and the resilience of markets in the face of unpredictable events.

— Curated by the World Pulse Now AI Editorial System