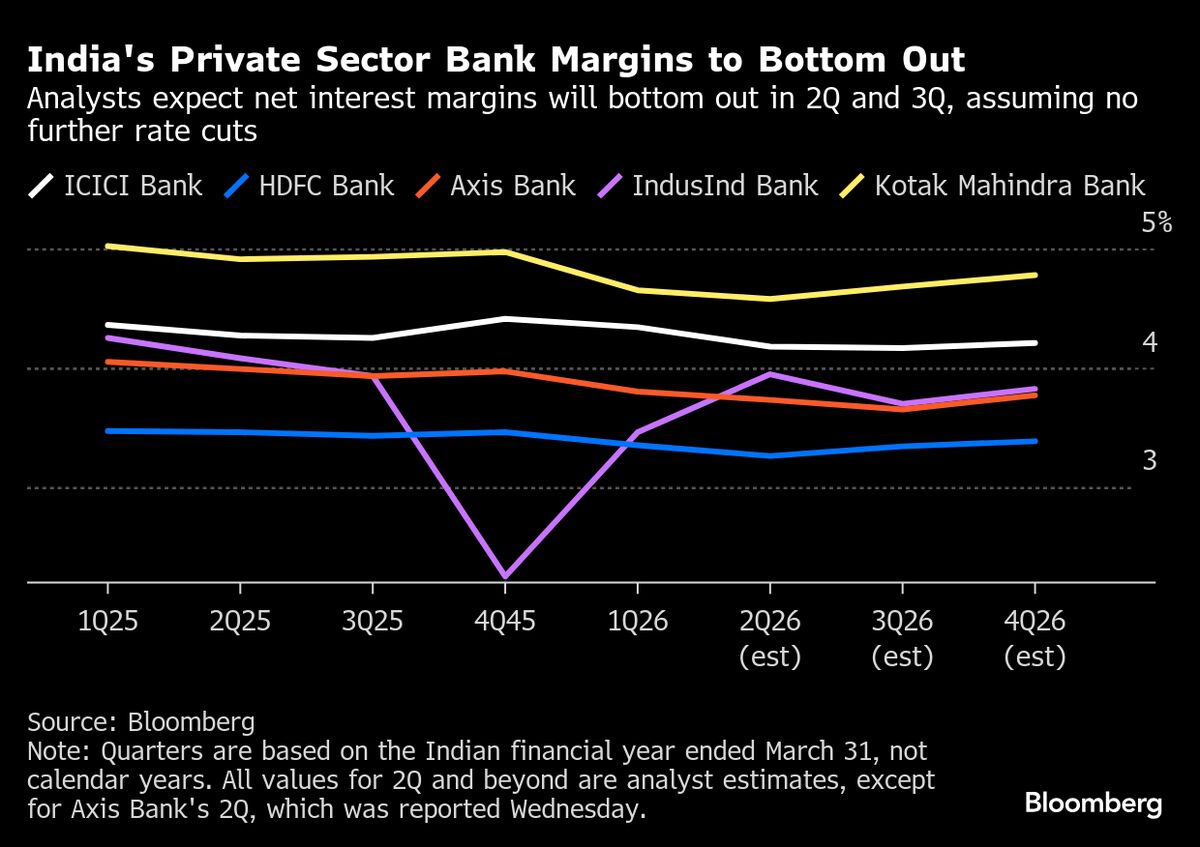

India Banks’ Lending Margins to Bottom Out as Rate Cuts Settle In

PositiveFinancial Markets

Recent earnings reports from major Indian banks like HDFC Bank and ICICI Bank suggest that lending margins have reached their lowest point, thanks to the central bank's recent rate cuts and tax incentives designed to boost economic growth. This is significant as it indicates a potential stabilization in the banking sector, which could lead to increased lending and investment, ultimately benefiting the broader economy.

— Curated by the World Pulse Now AI Editorial System