Redfin unveils major housing market news for homebuyers

NeutralFinancial Markets

- Redfin has reported a significant shift in the housing market, indicating that American homebuyers are facing affordability challenges as the average 30-year fixed mortgage rate stands at 6.19%. This trend suggests a growing imbalance with more sellers than buyers, marking 2025 as a notably strong buyer's market.

- This development is crucial for Redfin as it highlights the changing dynamics in the housing market, potentially affecting sales strategies and pricing. The company must navigate these shifts to maintain its competitive edge and support homebuyers amid rising mortgage rates.

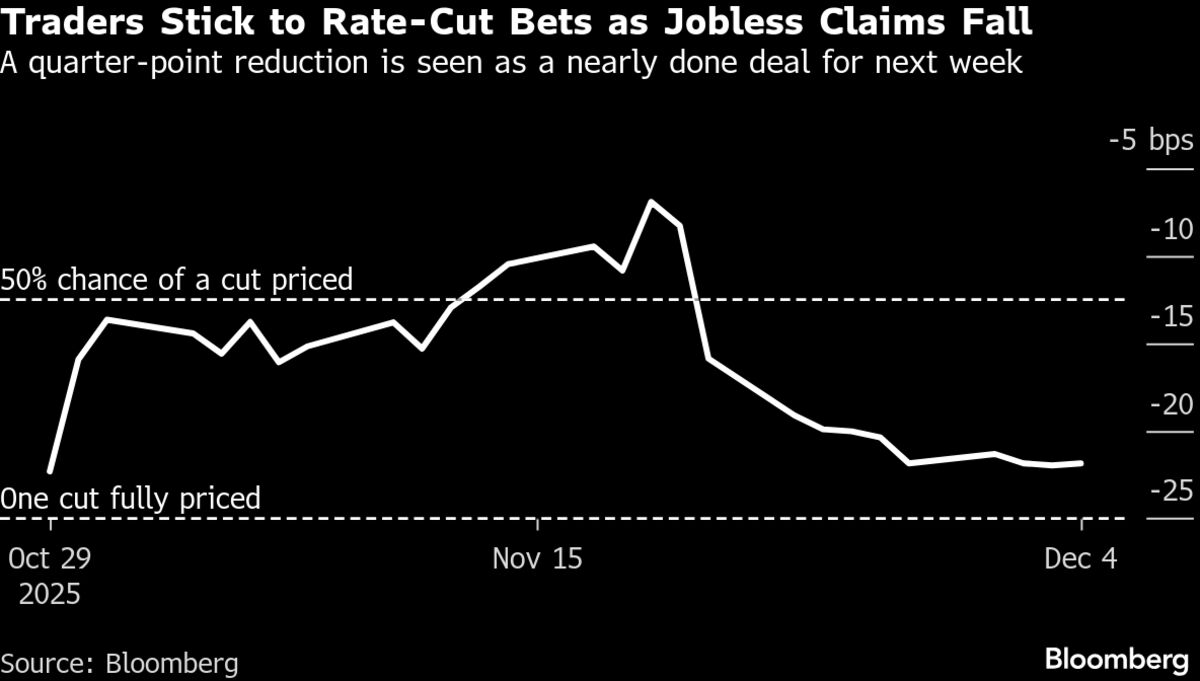

- The broader economic context reveals increasing speculation about potential interest rate cuts by the Federal Reserve, which could influence mortgage rates and housing affordability. As the Fed grapples with inflation and employment concerns, the interplay between monetary policy and housing market trends will be critical for both buyers and sellers in the coming months.

— via World Pulse Now AI Editorial System