Global Stocks Trade in Narrow Range Ahead of Key Fed Meeting

NeutralFinancial Markets

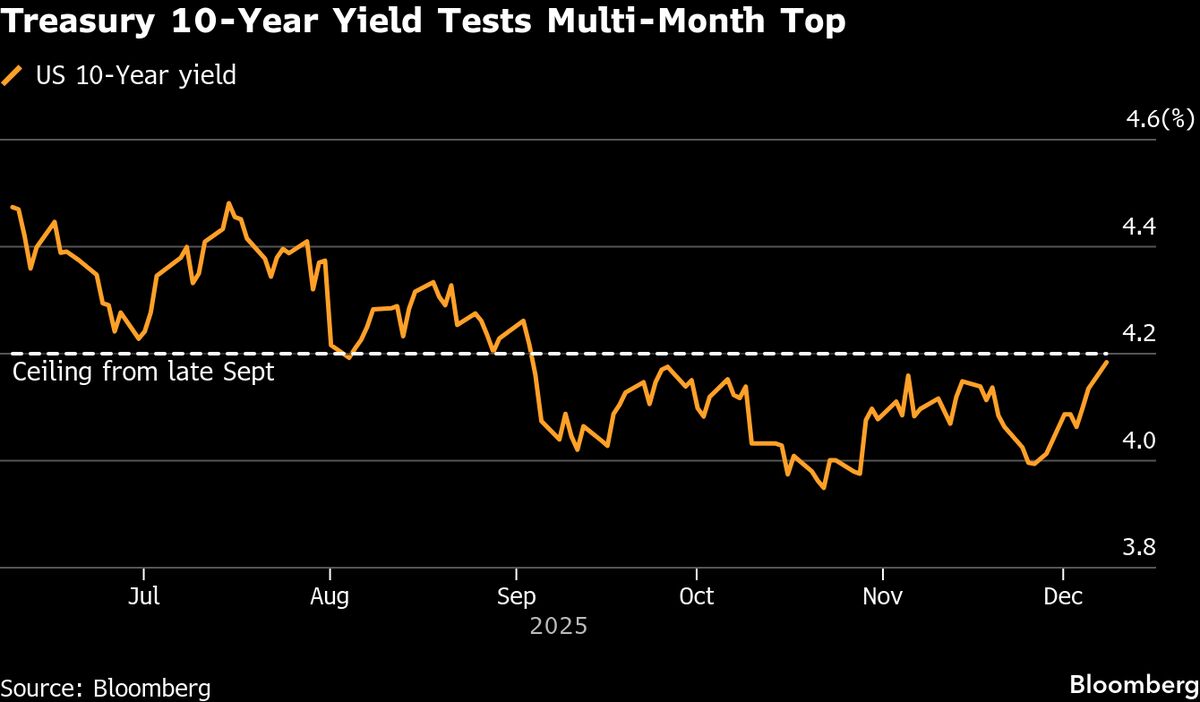

- U.S. stock futures showed slight gains as investors await the Federal Reserve's two-day meeting, which is expected to address interest rate policies. This cautious optimism reflects a broader market sentiment as traders prepare for potential changes in monetary policy.

- The outcome of the Federal Reserve's meeting is crucial for market participants, as any indication of a rate cut could significantly influence investment strategies and market dynamics. Investors are particularly focused on how the Fed's decisions will impact economic growth and inflation.

- The current market environment is characterized by mixed signals, with some sectors experiencing gains while others remain uncertain. The anticipation of the Fed's decisions is compounded by recent strong jobs data, which has not altered expectations for a rate cut, indicating a complex interplay between economic indicators and market reactions.

— via World Pulse Now AI Editorial System