Stocks Waver as Traders Stay on Sidelines Ahead of Fed, Oracle

NeutralFinancial Markets

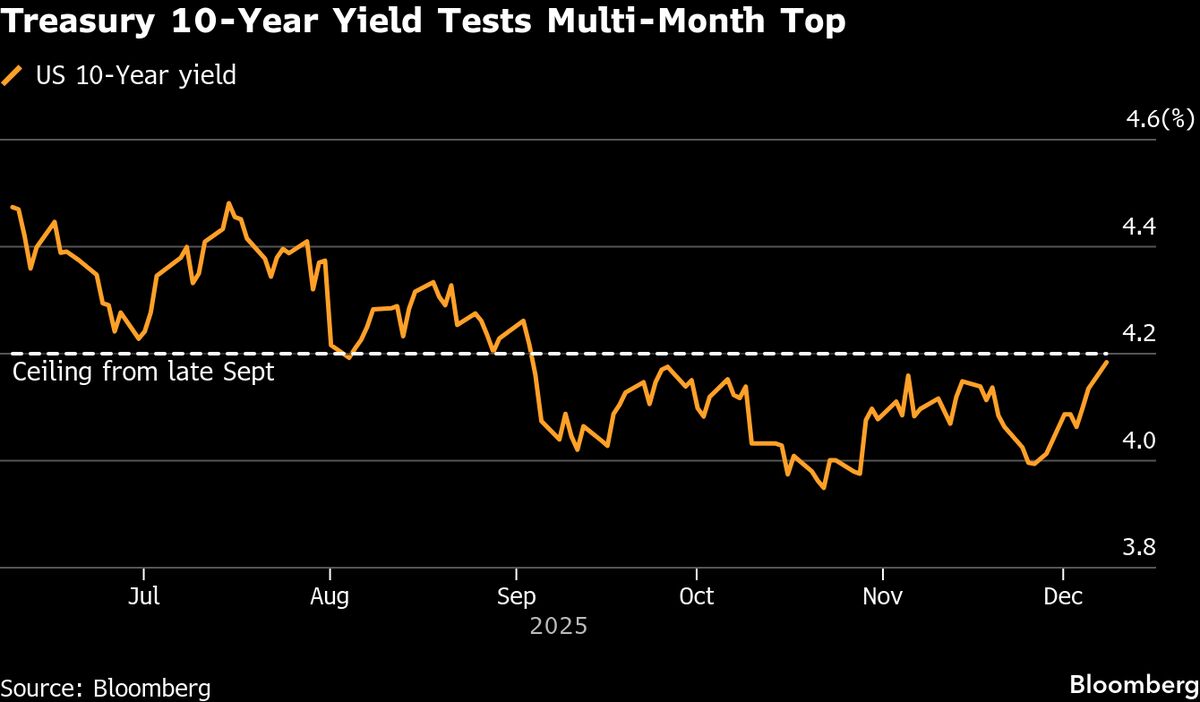

- US equities showed small fluctuations as investors remained cautious ahead of critical announcements from the Federal Reserve and Oracle regarding interest rates and corporate performance. This indecision reflects a broader trend as traders weigh their options heading into 2026.

- The Federal Reserve's upcoming decisions are pivotal, as they could influence market liquidity and borrowing costs, impacting investor sentiment and stock valuations. Oracle's performance is also under scrutiny, with analysts adjusting their price targets amid changing market dynamics.

- The current market environment is characterized by mixed signals, with some sectors showing optimism due to potential rate cuts, while others remain uncertain. The interplay between job data, tech stock performance, and Federal Reserve policies continues to shape investor strategies as they navigate a complex economic landscape.

— via World Pulse Now AI Editorial System