U.S. Treasury Yields End Higher

NegativeFinancial Markets

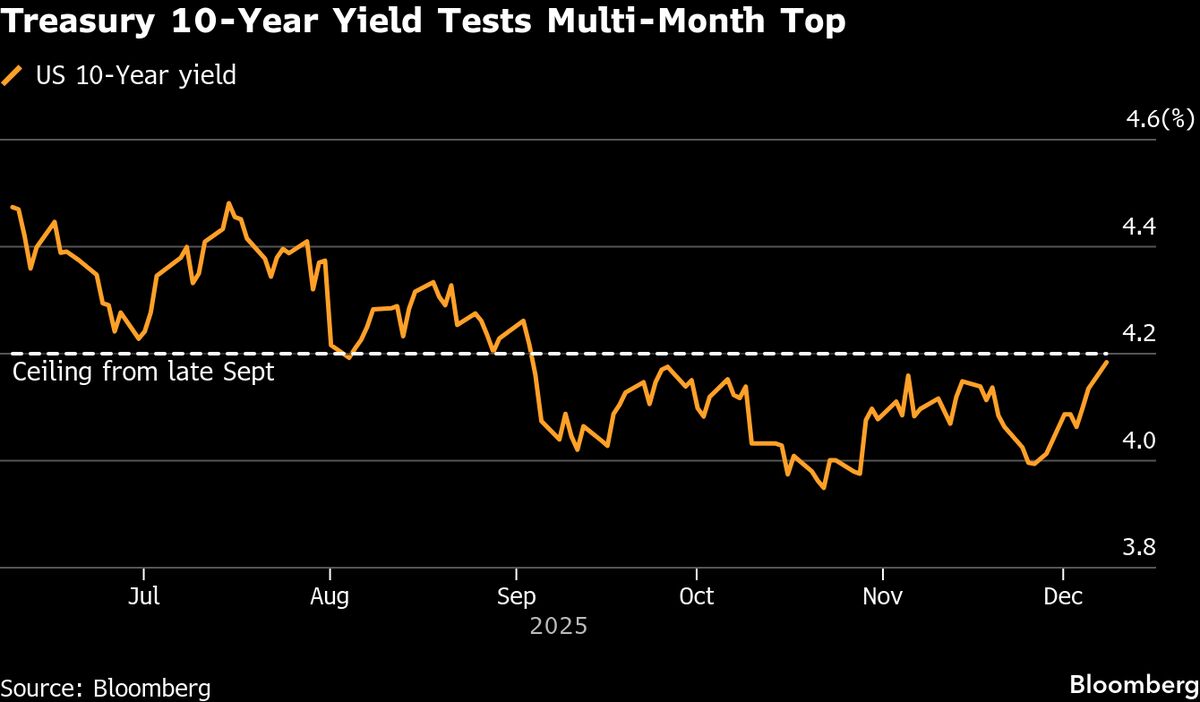

- U.S. Treasury yields rose as the market continued to experience a selloff, driven by traders preparing for the Federal Reserve's final meeting of the year. This trend reflects ongoing uncertainty in the bond market, with yields increasing amid fluctuating economic indicators.

- The rise in Treasury yields is significant as it indicates investor sentiment and expectations regarding the Federal Reserve's monetary policy decisions, particularly in light of recent jobless claims data and its implications for interest rates.

- This development highlights a broader trend of volatility in the bond market, as conflicting economic signals have led to debates about the Federal Reserve's potential actions, including interest rate cuts, which have been influenced by labor market conditions and investor sentiment.

— via World Pulse Now AI Editorial System