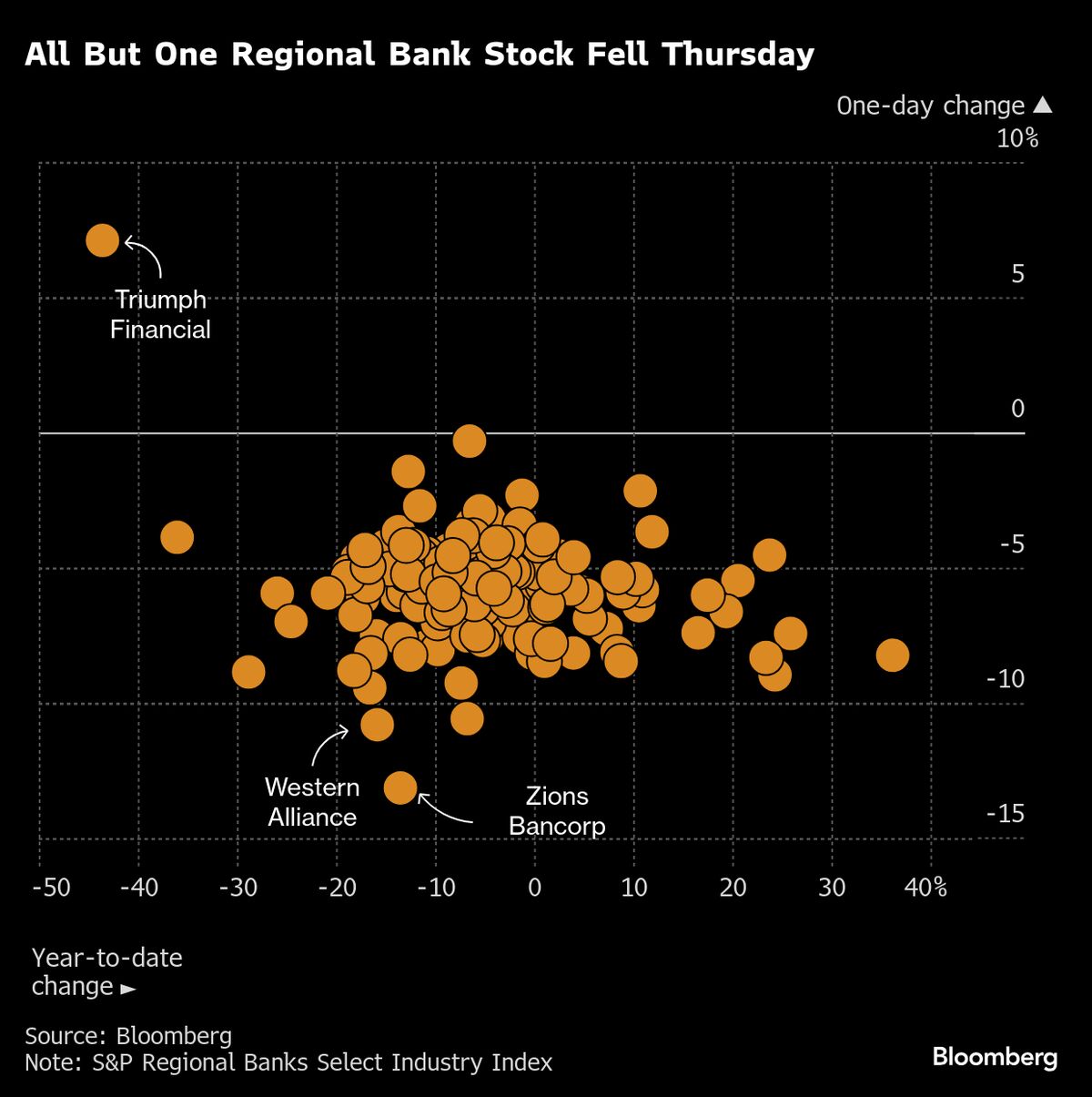

S&P 500 Finishes Lower as Regional Bank, Insurer Concerns Weigh

NegativeFinancial Markets

On Thursday, US stocks, particularly the S&P 500, experienced a decline due to rising concerns about the quality of loans at regional banks and the growth prospects of insurers. Additionally, ongoing tensions between the US and China have further dampened investor sentiment. This matters because it reflects broader economic uncertainties that could impact market stability and investor confidence.

— Curated by the World Pulse Now AI Editorial System