US Treasuries Wrap Up Worst Week Since April Amid Fed Doubts

NegativeFinancial Markets

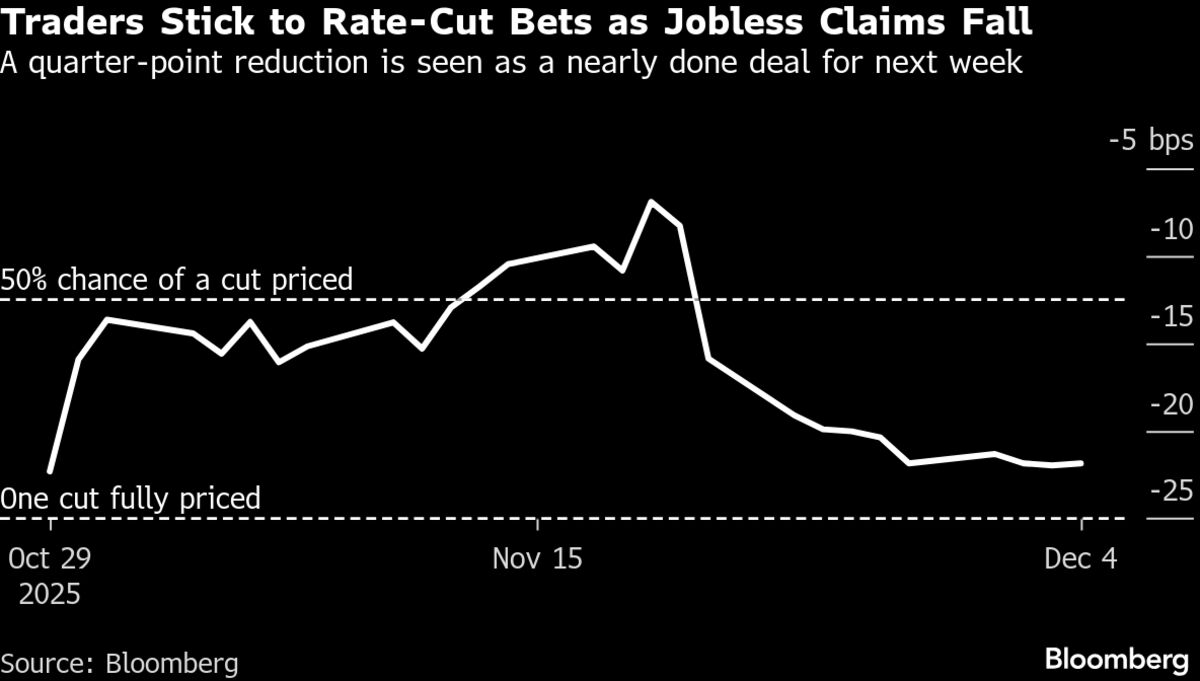

- US Treasuries concluded their worst week since April, driven by conflicting economic data that raised doubts about the Federal Reserve's potential interest rate cuts in the upcoming year. The decline in Treasuries reflects market uncertainty as investors grapple with mixed signals from the labor market and economic indicators.

- This downturn is significant as it highlights the fragility of investor confidence in the Federal Reserve's monetary policy direction. The recent drop in jobless claims, which fell to their lowest level since 2022, suggests a tightening labor market, complicating the Fed's decision-making process regarding interest rates.

- The current volatility in Treasuries is part of a broader trend where market participants are increasingly focused on the Federal Reserve's actions and statements. As traders speculate on potential rate cuts, the interplay between labor market data and Fed policy remains a critical theme, influencing not only bond markets but also equities and overall economic sentiment.

— via World Pulse Now AI Editorial System