$12B farm aid, Tesla downgrade, and NVIDIA chips: Stock Market News

NeutralFinancial Markets

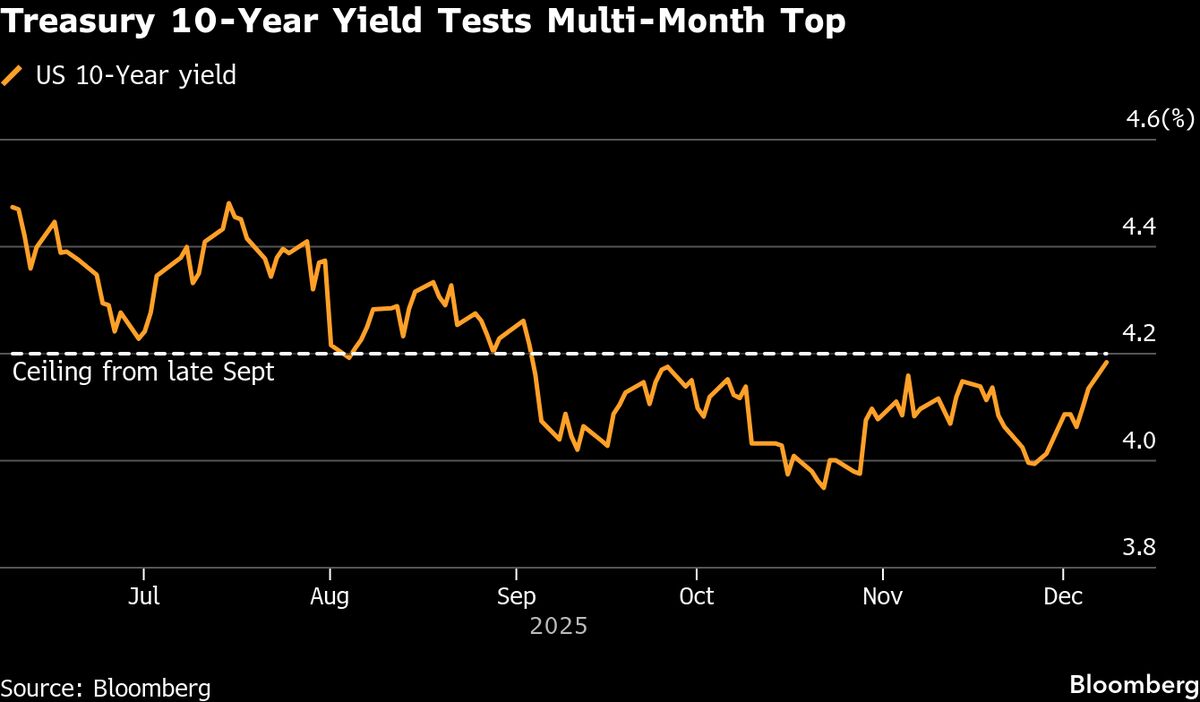

- The stock market began the second week of December on a bearish note, similar to the start of the month, with expectations of potential momentum from upcoming earnings reports from Broadcom and Oracle. The Federal Reserve's decisions on interest rates remain a focal point for investors.

- This development is significant as it reflects the ongoing volatility in the markets, particularly for technology stocks, which have been influenced by broader economic indicators and the Federal Reserve's monetary policy stance.

- The current market dynamics highlight a complex interplay between investor sentiment, economic forecasts, and the performance of major tech companies, as concerns about inflation and interest rates continue to shape market expectations and reactions.

— via World Pulse Now AI Editorial System